No one likes to think about their mortality. But as we age, we begin to understand that an individual human life is fragile, uncertain and limited in time. The supramental transformation is in process. But it will take time to fully manifest and lead to the conquest of death. In the interim, we have the possibility and the capability to have an impact on the transformational effort from beyond the grave, if we undertake the required planning.

This brings us to the Mother’s project, Auroville. Auroville is meant to be a laboratory for human evolutionary change on all levels of human existence, physical, vital, emotional, mental and spiritual. Auroville is going to require massive investments in order to fully carry out the Mother’s dream, and these investments will necessarily span decades.

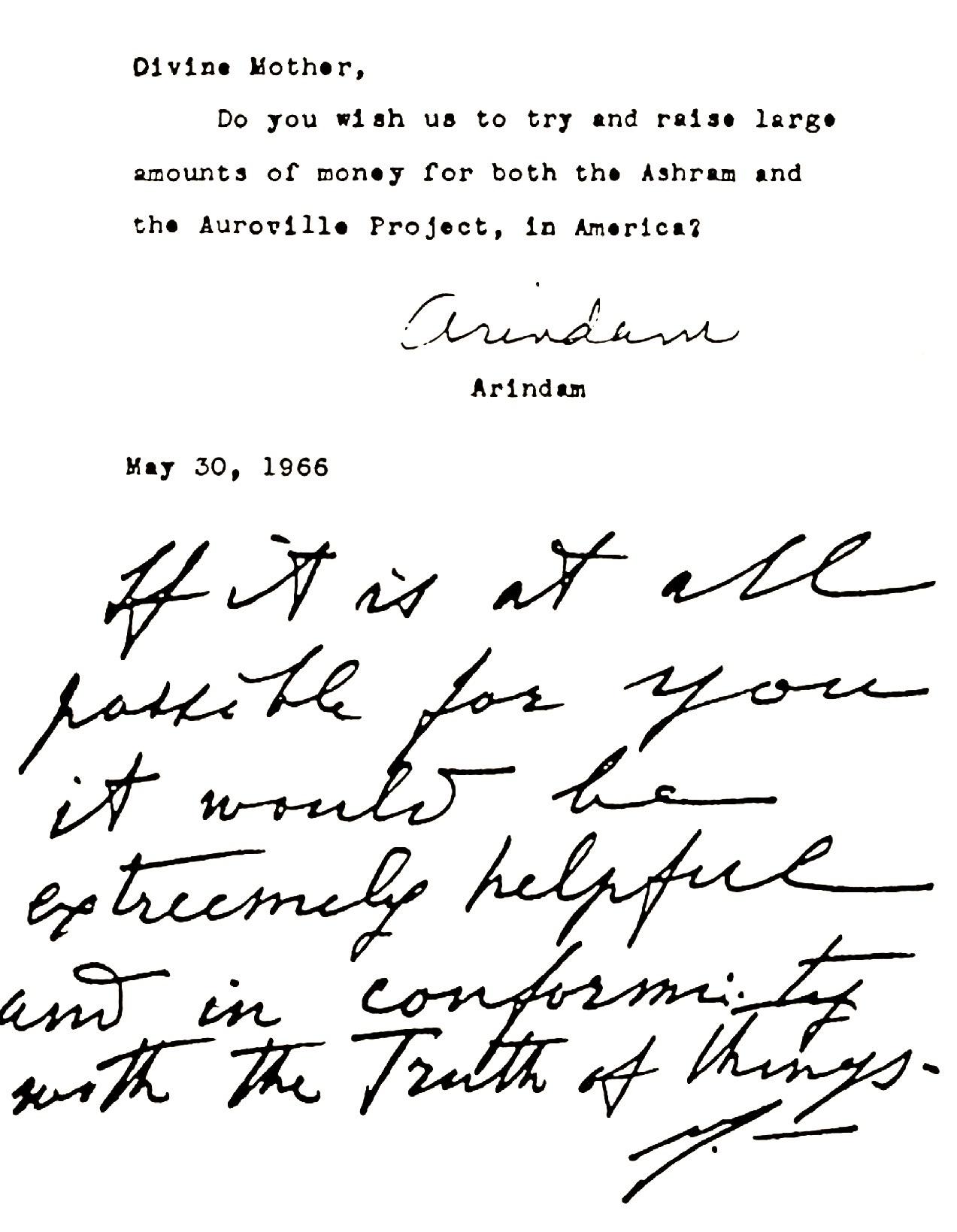

The Mother recognized that those who are destined to live and grow in the West would have a unique role to play in the development of Auroville, as the economic organization and material prosperity developed in the Western world, and in particular in the USA, was a unique development of the ‘money power’. She therefore identified the West as the source of funding for Auroville’s growth and development.

Many of us make regular contributions to Auroville’s development. This support need not stop when we transition out of this incarnation. We know that we can’t take our assets and income streams with us when we go. And they don’t need to be passed on to someone with very different views of how to invest them.

We can make an outright bequest in our will to the Auroville project. We can, of course, dedicate a share of current assets and income to the project during our lives to reduce what eventually winds up in the estate. We can provide for Auroville with donations that are tax deductible and thus, optimize our present income stream. There are ways to donate appreciated stock and not have to declare the capital gains, but get the tax deduction.

For those who have to take minimum distributions out of an Independent Retirement Account (IRA), there are methods to donate a portion of the distribution directly to AVI-USA and have it counted as part of the distribution without then becoming taxable income.

And there are other vehicles that can be used, such as something called a “charitable remainder trust”. This type of trust dedicates specific assets to the charitable project, yet reserves the income stream to the donor during a specific period of years, with a partial tax deduction available for the residual value of the assets so donated. We can also set up a Trust whose mission is to support the work of Auroville, (as well as other projects we care about).

AVI-USA has developed resources in the form of knowledgeable individuals familiar with estate planning and the various charitable options available and they can put you in touch with one of these individuals for a confidential and detailed discussion about the best way to proceed and support the Mother’s action long after your departure to “the other side camp” as our First Nations’ friends call it.